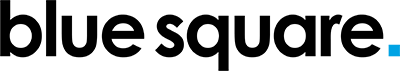

As always, Pulse returns with our patented ‘comfortability’ (credited to Connor Triggs) level analysis. We ask our consumers if they are comfortable in varying store formats and group them into three groups based on their responses: confident, cautious and reluctant.

As time progresses with each wave we’ve seen shoppers become more confident about getting back through the shop doors. This wave has been no exception.

And while none of us know the future plans around lockdowns right now, there is clearly a trend in the data towards being more comfortable in retail than at the start of the pandemic. These stats certainly give me less certainty felt around the entire idea of retail moving completely online; there is a determination to get back into physical retail.

And despite younger audiences falling into the ‘cautious’ category mostly, Gen Z sticks firmly in the middle of the road with only 15% being ‘reluctant’ to go into physical stores.

The most important priority from wave 2 has changed! Safety is nudged from the top spot as 91% of consumers claim convenience is a key priority when shopping. This value is up, reasonably sharply, from 85% from the last round of research. And previously we saw that convenience was more of a demand of older consumers, but that curve has now flattened with all generational groups showing as 91%.

It’s only the market’s reluctant shoppers, those shoppers who don’t feel comfortable in any physical store environment, that value convenience higher, but in comparison, this is only a small increase to 94%.

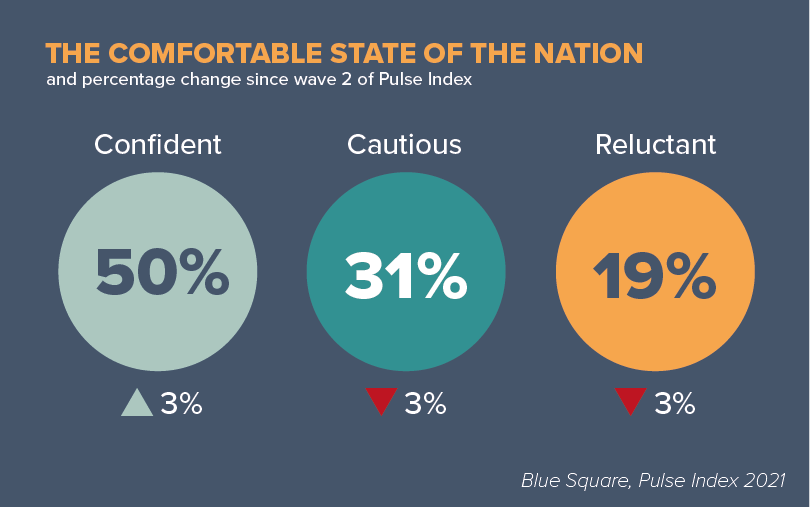

Safety does slip down to become the 2nd highest priority for shoppers but only down to 90.5% overall so both this and convenience are at the forefront of peoples’ minds right now.

This topic is actually a bit more of a divisive one than convenience, with a split seen between males (88%) and females (93%), but the biggest split is seen unsurprisingly by age, with older consumers being more cautious when it comes to being safe in-store.

In Q3 of 2020 Pulse Index discovered that 61% of people agreed with this statement. With the ongoing effects of the virus becoming more obvious this number has jumped to 76% in our most recent round of research.

This agreement is seen most strongly in our ‘cautious’ grouping at 81% with ‘reluctant’ being the least likely to agree with this statement at 73%.

When looking at location, those in urban settings are more likely to agree with this statement as well, with the figure decreasing slightly for consumers living in rural areas.

With Millennials covering a very wide range of purchasing categories — these consumers potentially moving out for the first time into rented accommodation or becoming first-time buyers — it makes sense that they are going to be responsible for a lot of the considered purchase products.

But due to the restrictions in place 70% of Millennials are likely to push back their planned purchases. This soars well above the 55% for Gen X and 54% for Gen Z. Unfortunately, this isn’t exactly helpful news for car retailers and manufacturers where Millennials are 6% more likely to purchase than the average.

Increasing 3 percentage points since wave 2 of Pulse Index research, 84% of consumers now state customer experience is a key priority when shopping. Females tend towards agreeing with this statement more (86% vs 81%) with Millennials being the biggest generational group to agree with this 87%.

And while the growth of the consumer who sees brand as a key priority is only 1 percentage point to 63%, it should be considered a nota bene in the footnotes of these stats. A disinterested consumer base provides opportunity and risk that only brands that engage directly see the true benefit from.

One of the most interesting trends coming from this brand priority data is in the age and income groups. Pulse Index shows that the core of brand advocates come from wealthier homes — 70% of the wealthiest third agreeing with the statement. We also see that younger audiences over-index with agreement for this statement with Gen Z and Millennials at 74% and 71% respectively. So brand advocacy is driven by those young and wealthy lot, and throw in an urban location to that base and we see a further increase!

4 in 5 confident consumers agree that the physical store is an important aspect of their future shopping habits. There is very little distinction between demographic groupings for this stat, with only a very slight weighting towards younger audiences here.

As I stated in point 1, the world shifting to an online-exclusive purchase journey doesn’t seem to be so solid in terms of expectation anymore. Regardless of how consumers are being forced to shop now, the desire for the future should be factored in.

We’ve got tons more of this data that we’re happy to share with you. No matter your current channels or product categories, we’d love to talk more to you about any key interests and how we can create a bespoke research project for you that will help better targeting of consumers and creating a much more immediate impact in your industry.

Blue Square has the ability, resources and knowledge to take your brand and represent both physically and virtually (and the lovely bit where these two overlap) in an omnichannel market that is always-on. Feel free to drop any of us a message to talk more about how we can help you.

Get in touch via linked in;

Kirsti Horne

Richard Dockerill

Connor Triggs