Our newest wave of Pulse Index has given us another deeper insight into the minds of consumers and their considered purchases, across the UK and Ireland. And as we know, the status of global pandemic that brought us to a grinding halt has, unsurprisingly, meant that consumers flocked towards online purchase. Despite the general consensus being that the online-retail split shifting towards the virtual marketplace was a permanent feature of retail, wave III of Pulse Index continues to suggest otherwise, as we continue to see an inclination from the public to get back into bricks-and-mortar.

But in reality, it doesn’t end there. With a desire to move back to bricks-and-mortar being seen by many demographics, there’s still a huge segment across all demographics that truly embrace both the physical and online purchase paths bringing the world of omnichannel to the forefront of people’s minds (even if they have no idea they’ve gone omnichannel themselves).

At Blue Square, we fully believe that the future of retail is an always-on approach to make sure a brand’s customers can get in contact as and when it best suits them. This is where we believe in the power of harmonised retail.

So with that in mind, I’ve dived into the data and here are 5 key takeaways of how consumers see the landscape of harmonised retail and what your marketing team can do to reap the benefits.

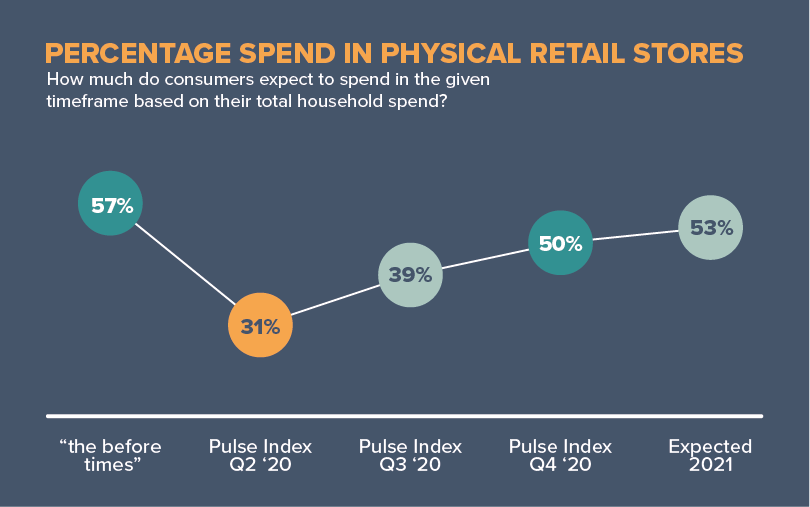

As you may have noticed, UK retailers saw a massive shift to online in Q2 last year and for obvious reasons. But since coronavirus lockdowns across the UK came in and non-essential shops were forced to close, Pulse Index has tracked the desire to return to retail for UK and Irish consumers, asking their intended spend online and in physical locations.

So, some great news with the intention to spend back in retail being on the rise. And even if lockdowns do continue and this shift doesn’t happen immediately, there is an increased intention to spend in retail as we move through current restrictions in shops.

And generationally, it’s interesting that Gen Z and Baby Boomers are those expecting to spend the most in retail, with Millennials being the “most online” group, however their expectation for online spend is only 50.5% – a mere 2.5% below the population average.

One of the things we continue to observe in Pulse Index is the intention and attitudes towards various types of shopping initiative. We asked our audience their intended usage of online and in-store scheduled appointments with a dedicated brand representative. Positive reviews for both of these, if used, are at 88% but only 67% and 64% were aware of in-store and online appointments respectively.

So having a brand ambassador available to do that is a great idea (something like an award-winning Blue Square field team, perhaps). But you then need to make sure your customers are aware that service exists, and with 9 in 10 feeding back positively, if used, it’s a great tool in a world where popping to the shops is not so easy.

When looking at how consumers purchase, for anyone that researches or purchases in both retail and online, we class them as omnichannel shoppers (OCS) and 58% of our audience fell into this grouping.

One of the questions to our respondents asked “Do you think your overall buying experience could be improved when purchasing each of the following products?” What’s really interesting is that the OCS was the dominant group that said “Yes” the most to this question. This was especially true for buyers of Tablet, Smart wearable and Headphone.

And when asked to rate overall experience of a product purchase pathway, Desktop PC purchasers from a retail-only journey scored the highest with an 8.9 out of 10; the lowest group was online-only Smart wearables scoring just 7.1 on average.

I think it’s a good idea to look at why an OCS may have had pain points at all; surely they were getting the best of both worlds? In theory yes, but it actually boils down to the type of person an OCS is. In reality, a consumer who is looking through multiple channels and sources of information is going to be more discerning.

When looking at pain points, respondents could answer for multiple pain points found during the journey. For online-only, 52% of shoppers reported at least one pain point, in retail-only, this increased very slightly to 53%. For omnichannel, this rocketed to a total of 71% of consumers finding pain points! Among these pain points, the main culprits are lack of product reviews, difficulty comparing products, a lack of stock, and a lack of information.

The real issue that the OCS ran into was a severe lack of people to speak to. If you recall from earlier, not everyone is aware of online or in-store appointments (if they are indeed available for a brand or manufacturer). Not surprising then, that a discerning and considerate OCS over-indexes on the pain points of a ‘sales assistant lacking knowledge’ (OCS 13% vs online-only shoppers 5%) and ‘wanting to speak to a product expert but being unable’ (OCS 9% vs online-only 5%).

This is really where harmonised retail kicks in. Your potential customers are scattered: online, offline and more often than not, both. It’s absolutely crucial that you are able to let them reach out to you, because from our research it’s clear customers want to do that. Being available directly face-to-face (at safe and healthy distances) or camera-to-camera via a web appointment has never been more important.

Because of the issues that consumers ran into, unsurprisingly there were many negative outcomes. For OCS, only 12% didn’t actually feel any actual consequence of a perceived pain point, but in regards to a total share of outcome of the pain points, OCS over-indexed in regards to spending less money because of those pain points (15% OCS vs 12% online and 11% retail) with 4% OCS completely abandoning their purchase.

Even if they end up buying your product, they may not associate your brand with an enjoyable purchase experience.

The biggest issue with all of this is that well over half of the biggest purchasing group had an experience that a brand could have made better, and while the old adage of not being able to please everyone all the time will always ring true, there is a significant amount that can be done to ensure that consumers don’t end up with a product that left them feeling completely unsatisfied.

Ultimately, while you should always be looking for a great financial return on your investments in store, don’t forget about customer advocacy towards your brand and your products. A happy customer is a long-term customer.

We’re a big fan of omnichannel at Blue Square and the chance help you engage with your customers, present or future, whether business or commercial, physically or virtually (or both?!) is our raison d’être.

There’s a lot more data and we have a lot more insight into the current trends of a variety of markets. We’d love to hear from you so, feel free to drop any of us a message to talk more.

Kirsti Horne

Richard Dockerill

Connor Triggs